fha gift funds cousin

For example a man. Per FHA Gift Funds Guidelines family members or relatives can give a home buyer gift funds up to 100 to be used towards a home purchase andor closing costs.

Fha Gift Funds How Can I Use Them To Buy A Home

The portion of the gift not used to meet closing requirements may be counted as reserves.

. Provide signed and dated gift letter from the gift donor a copy of the front and back of the canceled gift check or a copy of the gift donors full. Gift funds can only be used on primary residences. Similarly can a cousin give a gift on an FHA loan.

However gift funds cannot be a loan There is a letter that the donor needs to sign certifying that the gift funds are not a loan and that the gift funds will not be paid back. Also Know who does FHA consider a family member. Get the job done from any device and share docs by email or fax.

Seller Concessions and Reserves. The FHA also allows gifts from an employer labor union or a charitable organization. There are rules that permit a borrower to receive such outside help but the source and purpose of these funds are carefully regulated under FHA mortgage loan rules.

While cousins nieces and nephews arent able to give your gift under normal family guidelines with an FHA loan the FHA does allow for gifts from close friends who have a clear interest in your life. Fannie Mae Gift Funds Guidelines A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor. There are other acceptable sources as well.

What does this mean. The borrower isnt required to put any of his or her own funds when receiving a gift that takes care of the full down payment and closing costs unless the final loan amount is over. Commonly known as a down payment gift these funds work differently compared to traditional home loansIn turn using gift money for a mortgage down payment.

1 After the minimum borrower contribution has been met gifts can be used to supplement the down payment closing costs and reserves. 41551 5B4b Who May Provide a Gift An outright gift of the cash investment is acceptable if the donor. Two- to four-unit principal residence.

The official HUD handbook that is. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. However the FHA does allow for gifts from close friends and under those circumstances nieces nephews and cousins would qualify.

Turn them into templates for multiple use incorporate fillable fields to collect recipients. The real estate agent or broker. All funds needed to complete the transaction can come from a gift.

Joe Metzler JoeMetzler 1 ranked lender in Minnesota - 4535 contributions The very long standing standard mortgage loan rules require gift money to be from a blood relative or a substantial person with a documented interest in the buyer. In addition you can get gifts from a fiance or domestic partner. Does FHA allow a gift from a cousin.

With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins. FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned. When a gift from a relative or domestic partner is being pooled with the borrowers funds to make up the required minimum cash down payment the following items must also be included.

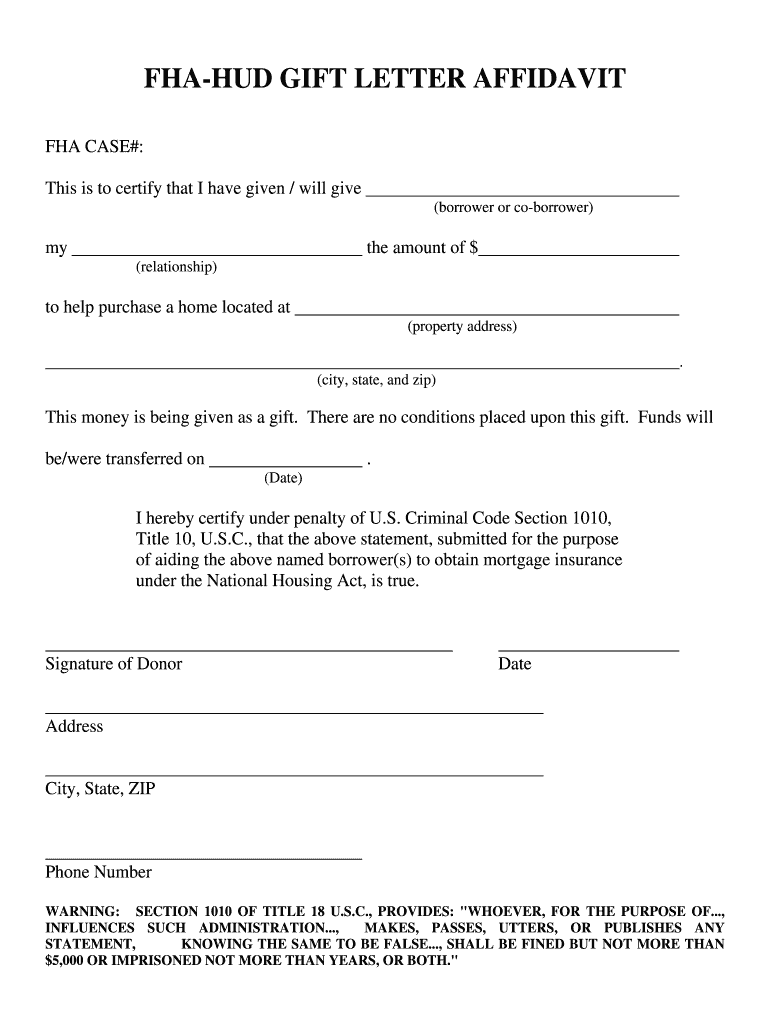

The FHA doesnt just list who may give such a gift--it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. A common example of this is a fiancee or boyfriend or girlfriend.

Gifts toward down payment do not have to always be in cash. This is not easy to do and documentation is very tricky. Sellers Concessions-FHA mortgage requirements allow for seller concessions of up to 6 of the sales price.

Information put and ask for legally-binding electronic signatures. Fha gift funds cousin. The gift donor may not be a person or entity with an interest in the sale of the property such as the seller.

But the gifted money doesnt have to come from a relative. Benefit from a digital solution to create edit and sign contracts in PDF or Word format online. FHA allows down payment gifts from family members.

To get the skinny on this you have to dig into the handbook. FHA Acceptable Donors. Down payments are one of the biggest hurdles to purchasing a home.

While cousins nieces and nephews arent able to give your gift under normal family guidelines with an FHA loan the FHA does allow for gifts from close friends who have a clear interest in your life. Gift funds may fund all or part of the down payment closing costs or financial reserves subject to the minimum borrower contribution requirements below. A family member can also use equity in a property as gift funds.

Gift funds are commonly used for home loan expenses including down payments but when the borrower accepts gift funds for the purpose of making that down payment the funds must meet FHA acceptability standards. Gifts are traditionally used for home loan expenses including down. FHA Single Family Housing Policy Handbook Glossary Handbook 40001 Glossary and Acronyms 1 Last Revised 12302016 FHA Single Family Housing Policy Handbook GLOSSARY 30-Day Account A 30-Day Account refers to a credit arrangement that requires the Borrower to pay off the outstanding balance on the account every month.

FHA loans do not require notarization of the borrowers signature. Fortunately if you havent saved enough of your own funds for a home purchase many lenders allow borrowers to purchase a home with gift funds. The gifted funds must be sourced and seasoned and cannot be borrowed by the donor.

The FHA single-family home loan rule book HUD 40001 has detailed instructions for the lender where gift funds are concerned. Gifts from these sources are considered inducements to. Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner.

Both FNMA and FHLMC allow gifts from a spouse child another dependent or any other individual who is related by blood marriage adoption or legal guardianship. The borrower must make a 5 minimum borrower contribution from his or her own funds. A certification from the donor stating that he or she has lived with the borrower for the past 12 months and will continue to do so in the new residence.

The new FHA Policy changes. The Borrowers Relative The Borrowers Employer or Labor Union A Close Friend - If the Borrower can CLEARLY define and document interest in the Borrower. There has to be a CLEAR defined connection.

FHA does allow gifts from approved charitable organizations government agency public entity and close friends who have a clearly defined and documented interest in the borrower.

Fha Gift Funds How Can I Use Them To Buy A Home

Gift Funds When Is A Gift A Gift According To Fha

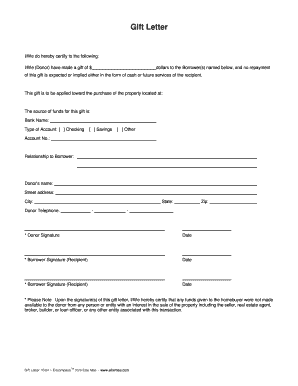

Mortgage Gift Letter Template Fill Online Printable Fillable Blank Pdffiller

Mortgage Down Payment Gift Rules What You Should Know

![]()

Using Gift Funds For Your Home Down Payment Divorce Mortgage Advisors

Gift Letter Document Gift Funds For Fha Or Conventional Loans

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Lettering

Fha Hud Gift Letter Affidavit Fill And Sign Printable Template Online Us Legal Forms

Fha Loan Rules For Down Payment Gift Funds

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Funds Guidelines 2022 Fha Lenders

Gift Fund Guidelines For Conventional Loans

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fannie Mae 5 Down Payment From Gift Funds Nc Mortgage Experts Teaching Quotes Teacher Quotes Inspirational Words